Homeowners Insurance in and around Louisville

If walls could talk, Louisville, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Investing in homeownership is a big deal. You need to consider your future needs location and more. But once you find the perfect place to call home, you also need terrific insurance. Finding the right coverage can help your Louisville home be a sweet place to be.

If walls could talk, Louisville, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Protect Your Home With Insurance From State Farm

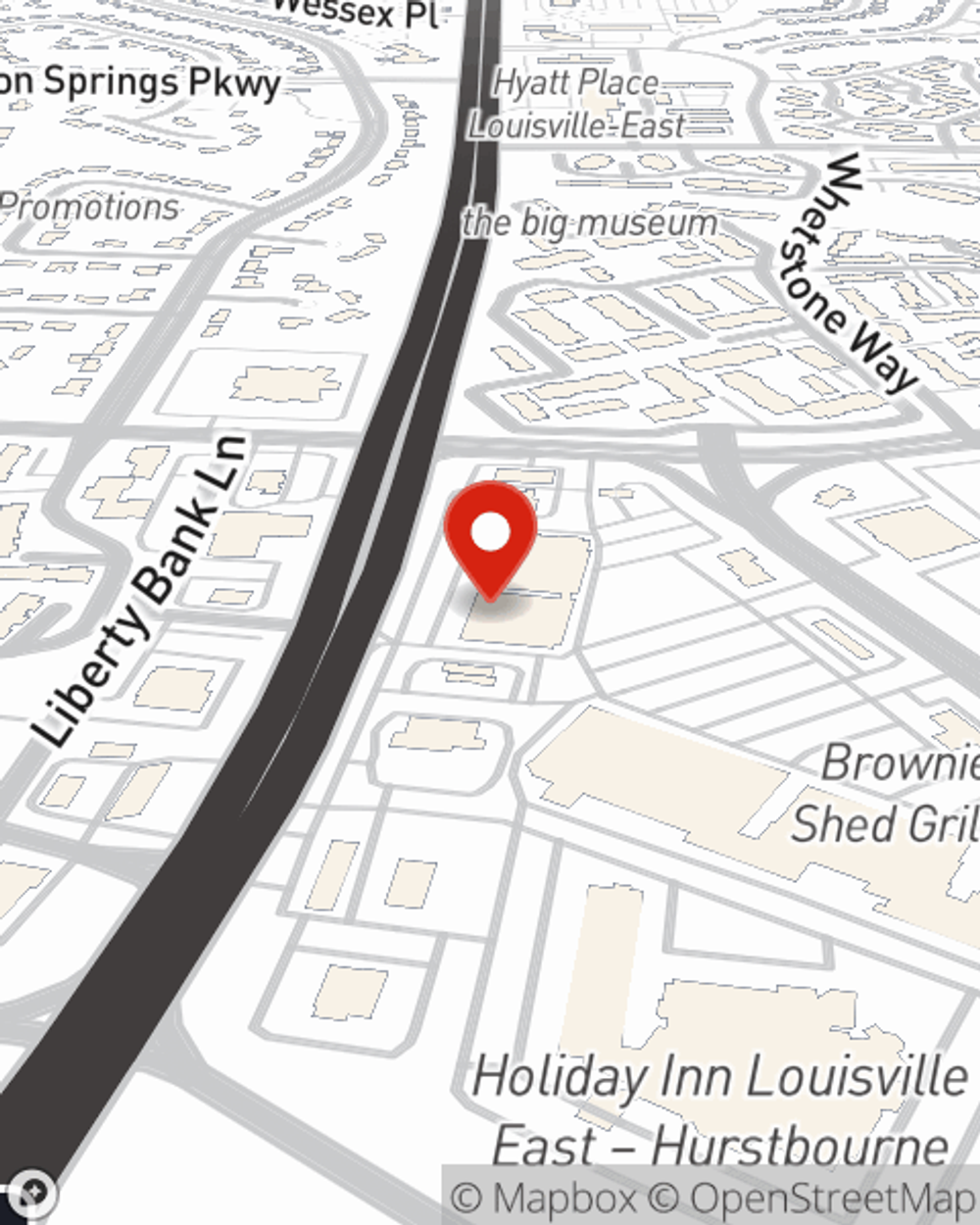

Agent Ryan Fetsch has got you, your home, and your valuables secured with State Farm's homeowners insurance. You can call or go online today to get a move on setting up a policy that fits your needs.

Having quality homeowners insurance can be significant to have for when the unanticipated arises. Contact agent Ryan Fetsch's office today to figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Ryan at (502) 429-4100 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.

Fire safety equipment to have at home

Fire safety equipment to have at home

Every residence should be prepared with home fire safety equipment to help in case of an emergency.

Ryan Fetsch

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.

Fire safety equipment to have at home

Fire safety equipment to have at home

Every residence should be prepared with home fire safety equipment to help in case of an emergency.